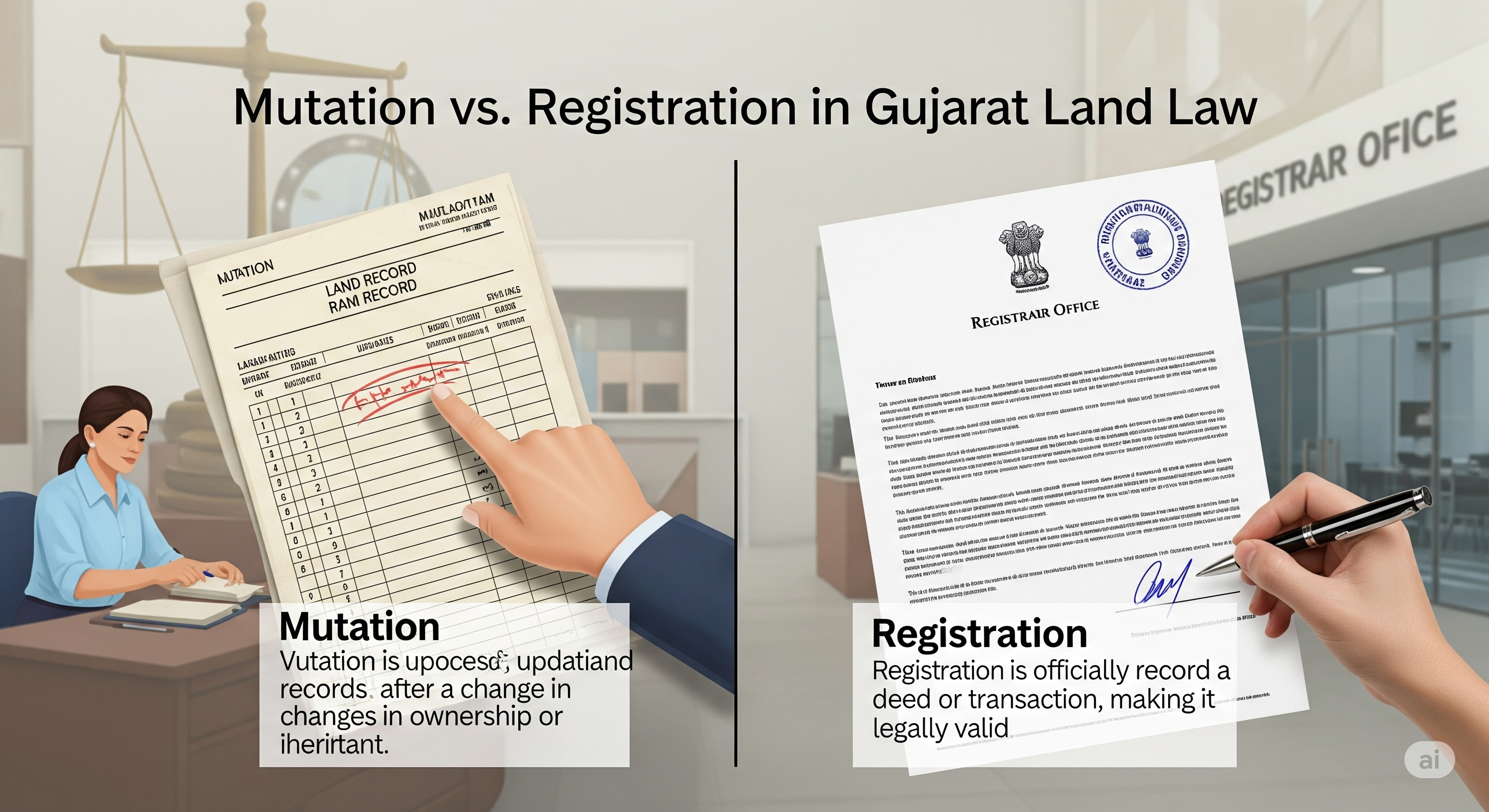

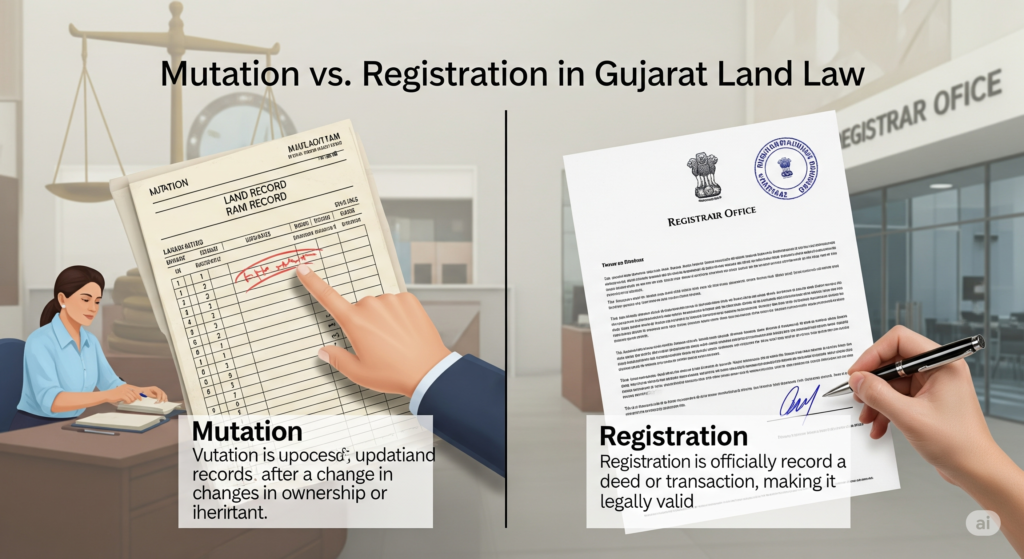

When dealing with property transactions in Gujarat, understanding the legal processes of mutation and registration is crucial. Many property owners confuse these two terms, but they serve entirely different purposes under Gujarat land law. While property registration legally transfers ownership through a sale deed, land mutation updates revenue records to reflect the new owner’s name.

This article explains the key differences between mutation and registration in Gujarat, their legal implications, and why both are essential for a seamless property transfer process.

Mutation vs Registration: Understanding the Key Differences

In Gujarat land law, both mutation and registration play vital roles in property transactions, but they serve different legal and administrative functions. Below, we break down their differences, processes, and importance.

1. What is Property Registration in Gujarat?

Property registration is the legal process of recording a property transaction (sale, gift, inheritance, etc.) with the Gujarat Registration and Stamps Department. It involves:

- Executing a sale deed (or other transfer documents) before a Sub-Registrar of Assurances.

- Paying the applicable stamp duty and registration fees (as per the Gujarat Stamp Act).

- Creating a legally binding record of ownership transfer.

Key Features of Registration

- Mandatory under the Indian Registration Act, 1908.

- Provides legal validity to the transaction.

- Helps in resolving ownership disputes.

- Required for obtaining loans or reselling the property.

2. What is Land Mutation in Gujarat?

Mutation (also known as “Khatedar Entry” or “Namantar”) is the process of updating the land revenue records to reflect the new owner’s name. It is done through the Gujarat Revenue Department (Talati or Mamlatdar office).

- Mutation does not confer ownership rights but ensures the government records reflect the current owner.

- Essential for property tax assessment and availing utility connections.

Key Features of Mutation

- Updates the 7/12 extract (Satbara Utara) and 8-A extract.

- Helps in property tax assessment under local municipal bodies.

- Required for agricultural land transactions in Gujarat.

- Does not replace registration but complements it.

3. Mutation vs Registration: Key Differences

| Aspect | Registration | Mutation |

|---|---|---|

| Governing Law | Indian Registration Act, 1908 | Gujarat Land Revenue Code |

| Purpose | Legal transfer of ownership | Updating revenue records |

| Authority | Sub-Registrar Office | Talati/Mamlatdar Office |

| Legal Effect | Creates ownership rights | Only updates records |

| Mandatory? | Yes for validity | Yes for tax & utility purposes |

| Documents Needed | Sale Deed, ID Proof, PAN | Sale Deed, Registered Document, Application |

4. Why Both Are Necessary in Gujarat?

- Without Registration: The property sale is not legally valid, and the buyer cannot claim ownership.

- Without Mutation: The government records will not reflect the new owner, leading to issues in tax payments, loans, and legal disputes.

5. How to Apply for Mutation in Gujarat?

- Submit an application at the Talati/Mamlatdar office with:

- Registered sale deed copy

- Identity proof (Aadhaar, PAN)

- Latest property tax receipt

- The revenue officer verifies and updates the 7/12 extract.

- The mutation entry is reflected in the land records (Bhulekh Gujarat).

Conclusion

While property registration legally transfers ownership, mutation ensures government records are updated. Both are essential for a hassle-free property transaction in Gujarat. Always complete both processes to avoid legal and financial complications.